Macro Newsletter

ARLP is an example of why the coal industry is rising again

- Alex Roseland

Looks like a great stock, but what’s the concern?

Alliance Resource Partners (ARLP) looks like a value investor's dream. The company tauts low multiples, healthy and growing dividend, solid fundamentals, skyrocketing EPS estimates… not to mention the price momentum of a paradigm changing tech stock. Structural problems in energy production have put ARLP in a prime position to capitalize on intense global demand. So what’s the problem? Well, it’s a coal company. Investors have many concerns around the coal industry, both in ethics and in long term sustainability. There are harsh headwinds from the energy transition, price competition from natural gas and renewables, along with ESG considerations.

In this article, I will explore these 2 counterweighting forces and explain why energy demand has been the clear victor and will continue to prevail over - at least - the next 1 to 2 years. The menacing prospect of a global recession may indeed threaten demand. But structural energy deficits could offset this. As well, a pivot back to stimulus from the Fed could further inflate commodities and benefit coal.

Concerns around the coal industry

Let’s get right to the heart of the matter. In much of the developed world, opinions have slowly shifted toward the view that carbon dioxide (CO₂) is a greenhouse gas that has been evidenced to be detrimental to the environment. Additionally, it is implausible that the world's leading scientific institutions have succumbed to a sinister conspiracy, or perhaps gravely misunderstood the basics of thermodynamics.

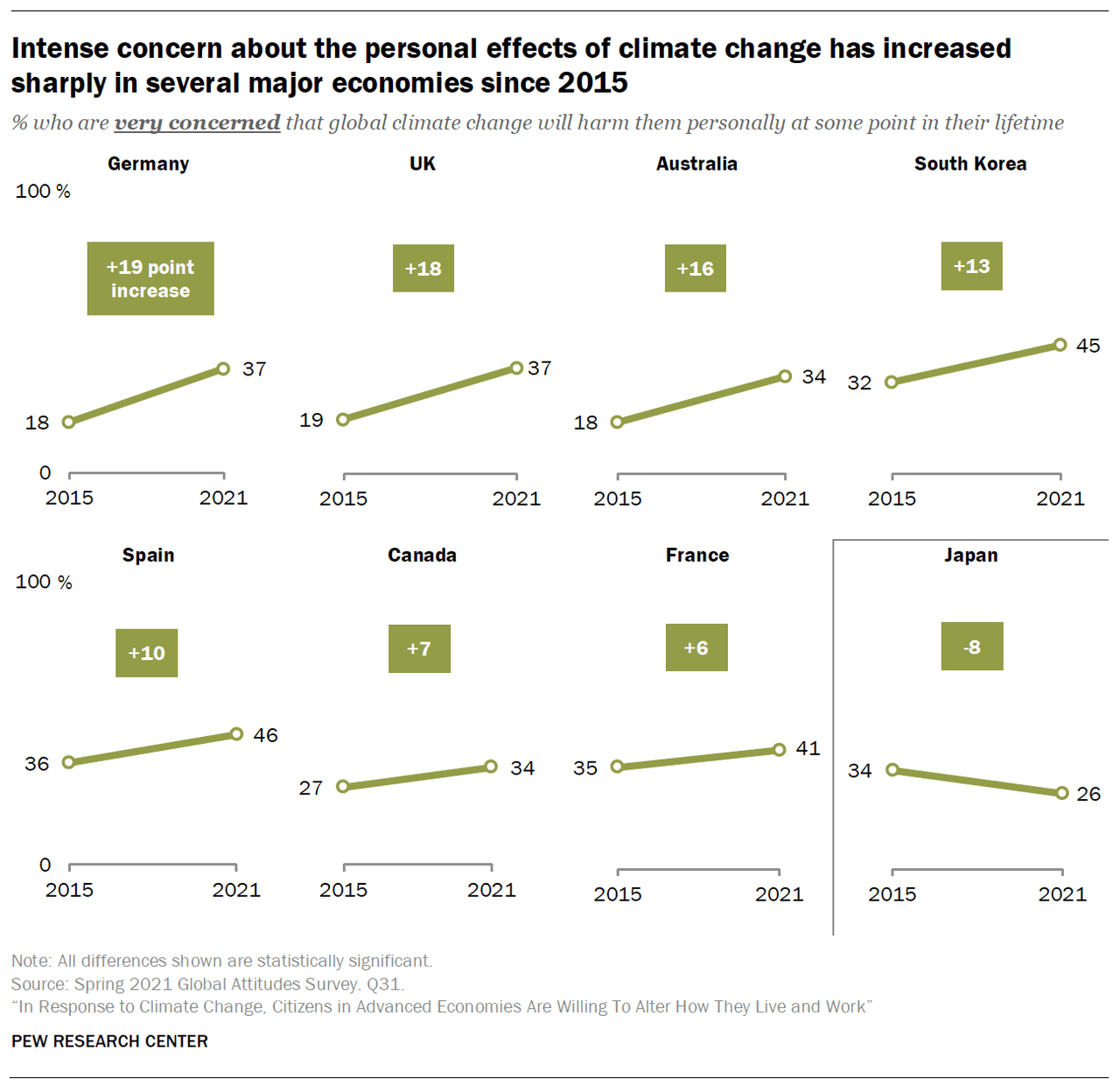

Pew Research

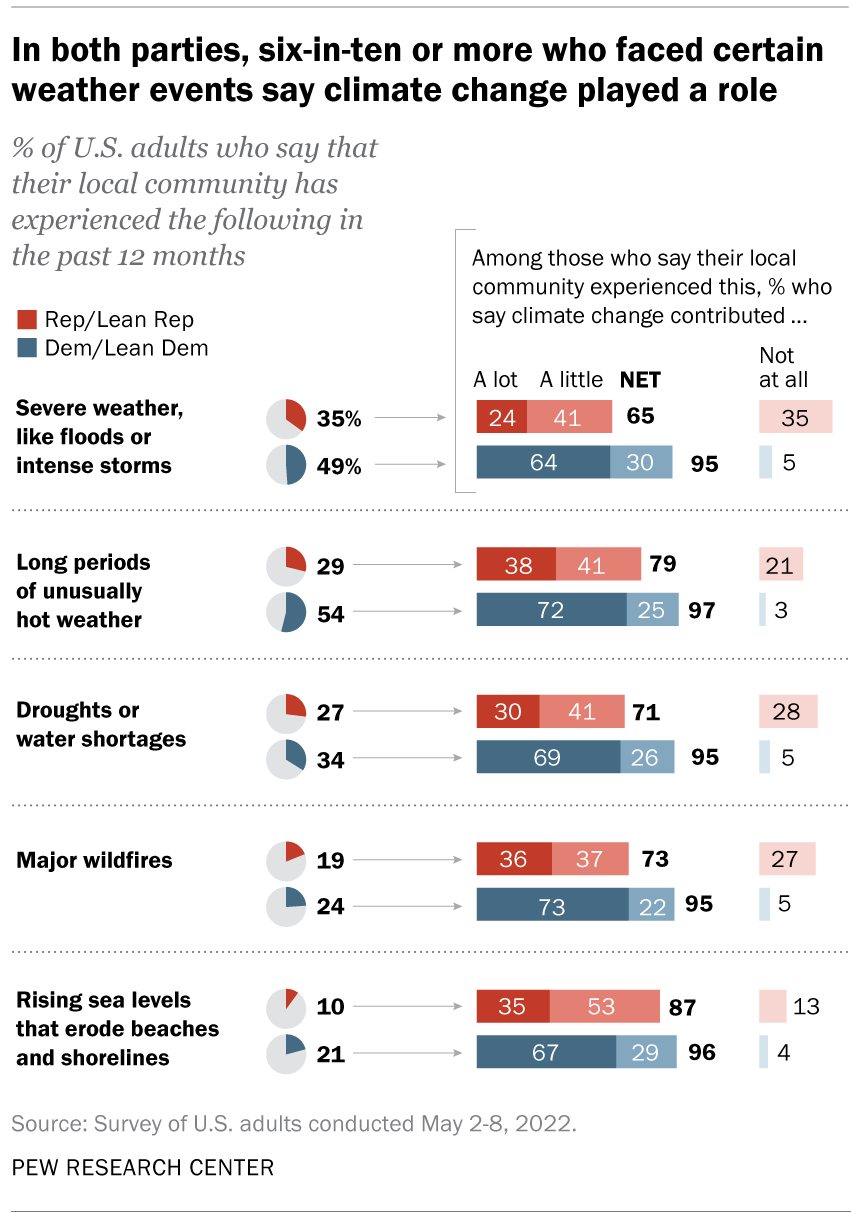

In the United States, among those who have recently experienced severe weather events (which amounts to approximately 71% of Americans), a sound majority of each political leaning say that climate change has contributed “a little” or “a lot” to these events - with the expected political divide not failing to present itself in the data. Noticeably, among those who experienced the more immediate and observable consequences of rising sea levels and eroding shorelines, 87% of those who identified as Republican thought climate change contributed at least somewhat (ie. “a little,” or “a lot”).

Pew Research

The political debate regarding this issue has not vanished by any stretch of the imagination, but the tone of this debate has shifted. You don’t often hear the word “fake” or talk of vast, multifactorial conspiracies counter to the underlying spirit of Occam’s Razor. The debate seems more focused on how serious climate change is, and whether solutions are feasible, or whether the economic toll can be tolerated.

Even most of the major oil producers, with the exception of Exxon Mobile, have laid out plans to convert to renewable energy production sometime within the next several decades (or so…), and seem open to ideas relevant to carbon capture. Websites aren’t quite shy about their ESG and positive environmental standings. Of course their CAPEX and R&D in this area don’t look quite as convincing as they should, but it’s hard to deny that the public narrative has shifted.

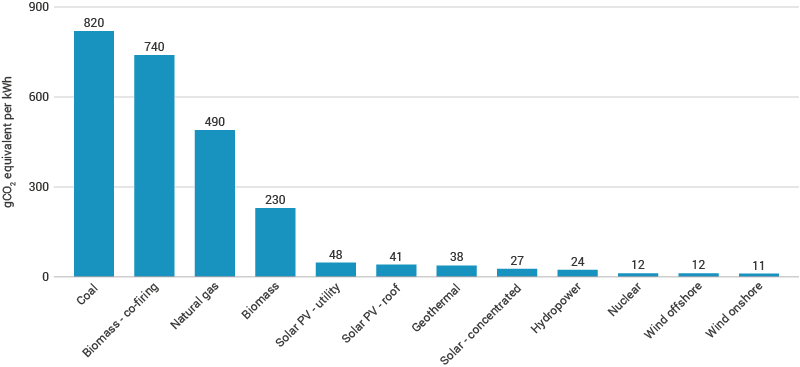

High carbon output

The coal industry has found itself in the crosshairs of these concerns around climate primarily due to the fact that it outputs the most amount of carbon dioxide per unit of energy (KWH). created.

Energy Stats

The industry has historically been hazardous to workers in several different ways. And, there is plenty of localized environmental damage - from mountaintop removal, to problems arising from inhalation and ground storage of coal, to ash to pumping pollutants into the environment (including our drinking water).

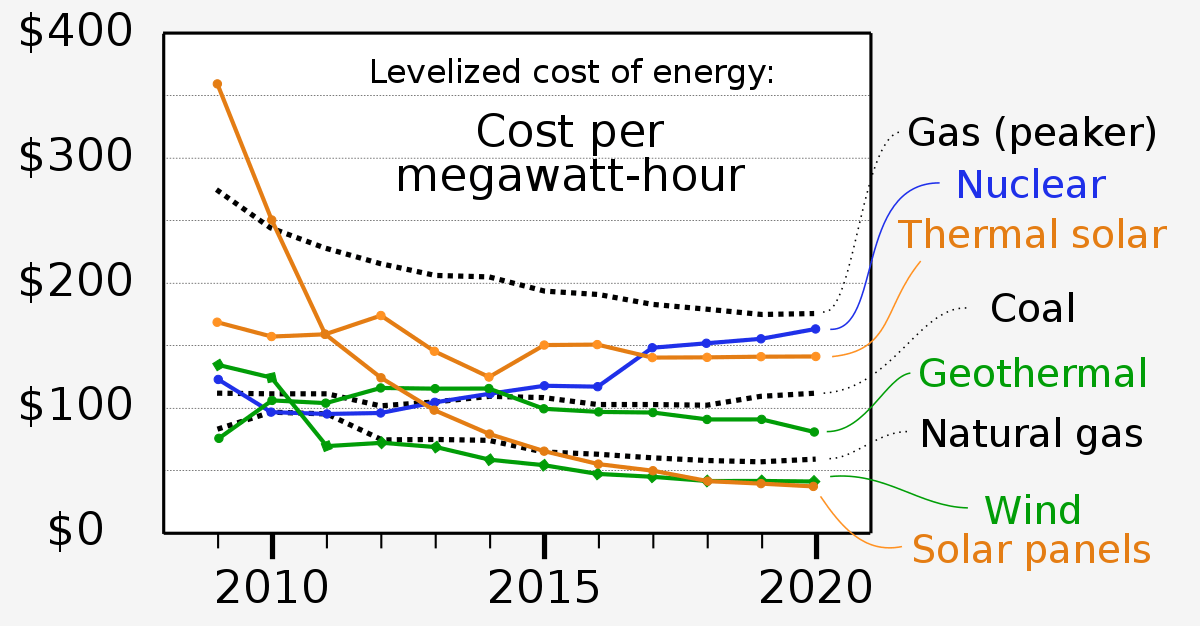

Price Competition

On top of the ESG concerns, coal also faces headwinds in price competition. Mostly from natural gas, photovoltaic solar, and onshore wind turbines. Coal has historically been a very low cost and abundant form of energy but large expansions of economy of scale along with innovations have decreased the costs associated with other forms of energy production. In looking at the report from EIA, which looks at the levelized cost of energy (LCOE) which basically takes the lifetime cost of the power plant and divides it by the lifetime energy output to ascertain the production cost of each unit of energy. Which is most commonly measured by a megawatt hour (MWh) which equals 1,000 kilowatts of electricity generated per hour.

The IEA report also projects future price decreases in other forms of energy production.

EIA Report

So should this industry go the way of the dinosaurs it burns? Yeah definitely! But will it anytime soon? No, probably not, today it probably offers growth and lavish dividends.

Demand Drivers for Coal

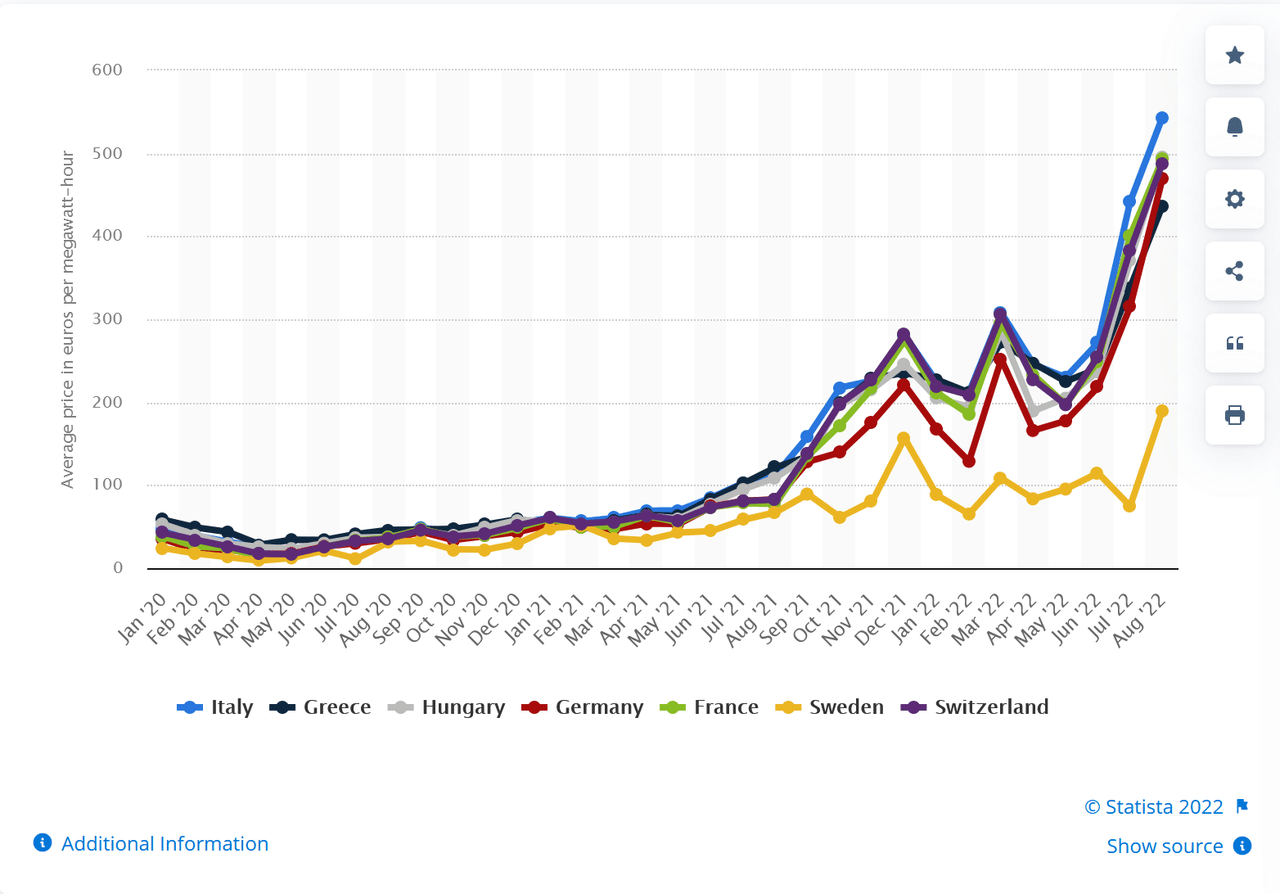

Let’s take a look at the primary demand drivers for coal. Most notably, we have a full blown energy crisis in Europe. The chart below shows energy prices exploding off the chart; roughly a 1,000% increase from the beginning of 2021.

Statista

This creates an intolerable problem for European citizens and their industry. Their factories require energy to produce products - as the energy prices go up, the cost of the relevant products go up - making them very uncompetitive concerning exports. This puts downward pressure on the Euro, people aren’t going to desire your currency if they don't want to buy what you’re producing. Moreover, they certainly don’t require it if you aren't producing anything whatsoever. Interventions contemplated by the EU to help subsidize the cost of energy will involve large amounts of deficit spending and expansions of the monetary supply being created by the central banks.

This essentially means the EU would be required to print money while already facing surging inflation. This also drives the value of the Euro down further, which raises the costs of their imports. All of this, in turn, plays a significant role in further inflation. Did someone say doom-loop?

There are primarily two reasons for these economic developments: 1) The obvious…Putin’s invasion of Ukraine and the subsequent economic separations. These have stopped natural gas imports entering Europe. Not to mention, China’s newfound dedication to aggressively bidding on the output by the Saudis - which they were happy to redirect. Wow, oddly enough it turns out that an islamic theocracy doesn’t display a plentiful amount of loyalty to a group of secular liberals in Europe - how unpredictable?

Reason 2) Instead of Western policy makers producing large amounts of renewable infrastructure like wind and solar energy, and then incrementally decreasing hydrocarbon fuel production, they did the opposite and invoked several policies and social levers to suppress and create divestment from the fossil fuel industry. And then, as if this were not egregious in its own right, they subsequently stood around nervously waiting for trillions of dollars of solar panels to appear out of thin air. In a shocking turn of events, policy makers are learning that prices are actually determined by supply and demand, not good intentions. When you suppress the supply - but demand stays the same - prices go up.

Let us not forget to mention one of the most egregious policy blunders in the last 70 years - Germany taking a completely reliable, green, safe, and unlimited energy source and simply turning it off. I am, of course, talking about nuclear power. This was mostly done as a general result of their populus making decisions based on emotions instead of the most cursory understanding of statistics or engineering.

“Indeed it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time.…”- Winston S Churchill

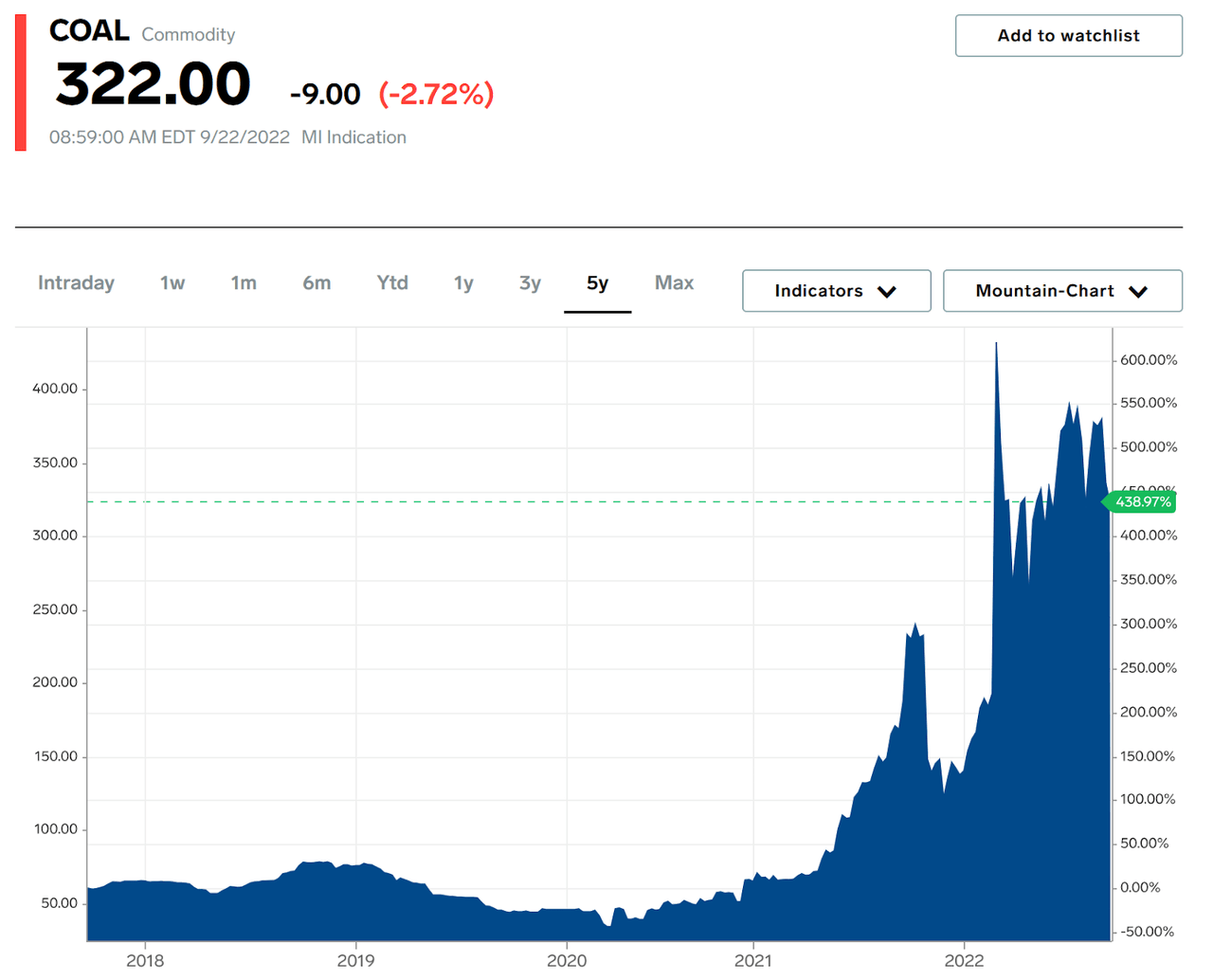

What does all this leave us: an incredible demand for coal. Below is a price chart of coal.

economics.com

A recent report by IEA shows all-time high coal consumption.

“Based on current economic and market trends, global coal consumption is forecast to rise by 0.7% in 2022 to 8 billion tonnes, assuming the Chinese economy recovers as expected in the second half of the year, the IEA’s July 2022 Coal Market Update says. This global total would match the annual record set in 2013, and coal demand is likely to increase further next year to a new all-time high.”

Europe is increasing coal consumption and reopening/extending plants.

“Coal consumption in the European Union is expected to rise by 7% in 2022 on top of last year’s 14% jump. This is being driven by demand from the electricity sector where coal is increasingly being used to replace gas, which is in short supply and has experienced huge price spikes following Russia’s invasion of Ukraine. Several EU countries are extending the life of coal plants scheduled for closure, reopening closed plants or raising caps on their operating hours to reduce gas consumption.”

Europe needs another source of energy that is readily available, and given the infeasibility of sourcing natural gas from Russia, the list of potential sources is short.

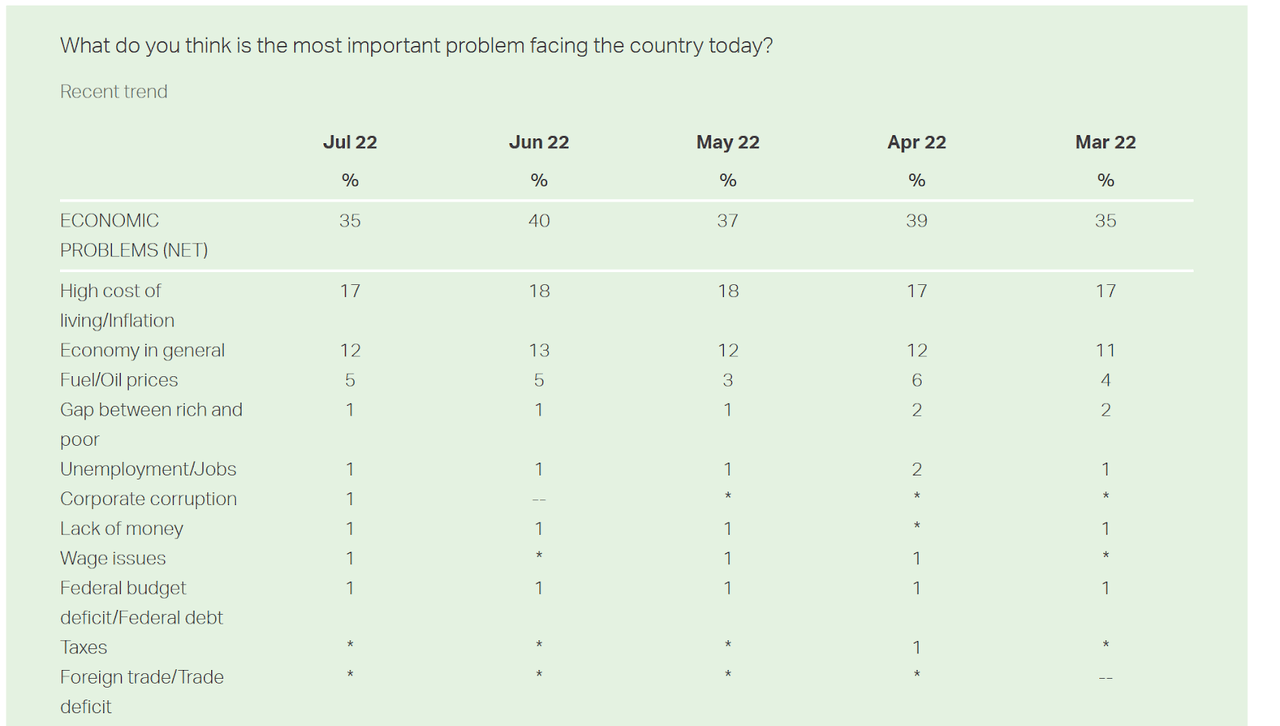

US Inflation

Inflation is ranked as the top economic issue per polling in the US right now. And, “environment, pollution, and climate change” is ranked 10th (3%) in non-economic issues, directly below concerns for “ethics/moral/religious/family decline”. If the current policy makers wish to stay in power beyond an election or two, one might posit that they should heavily prioritize inflation - and consider that energy is a very large and consistent contributor across almost all goods and services. Any measure that reduces energy production could correlate to election polling and probabilities of winning any given election. This is the point where political rhetoric and stump speeches have a hard time translating to reality.

Pew research

Europe faces harsh choices

If Europe were to face a cold winter (and storage of natural gas runs out) - not to sound hyperbolic - people could quite literally freeze to death. This may appear somewhat similar to the crisis Texas experienced, a state which typically has a moderate climate, but on a much larger scale. If so, the EU will be tempted to look east and capitulate to Putin. The US does not want to see this outcome occur, and could offset a dilution of allegiances by exporting substantially more natural gas to Europe. This would clearly create price contagion or shortages domestically, in which case coal would become an even greater demand. But this analysis is fairly speculative and somewhat rudimentary, merely an attempt to look into the gray fog of the future.

Supreme Court Ruling

The supreme court recently ruled that only congress has the authority to suppress industry based on climate concerns, not the EPA.

Huge Emerging Market Demand

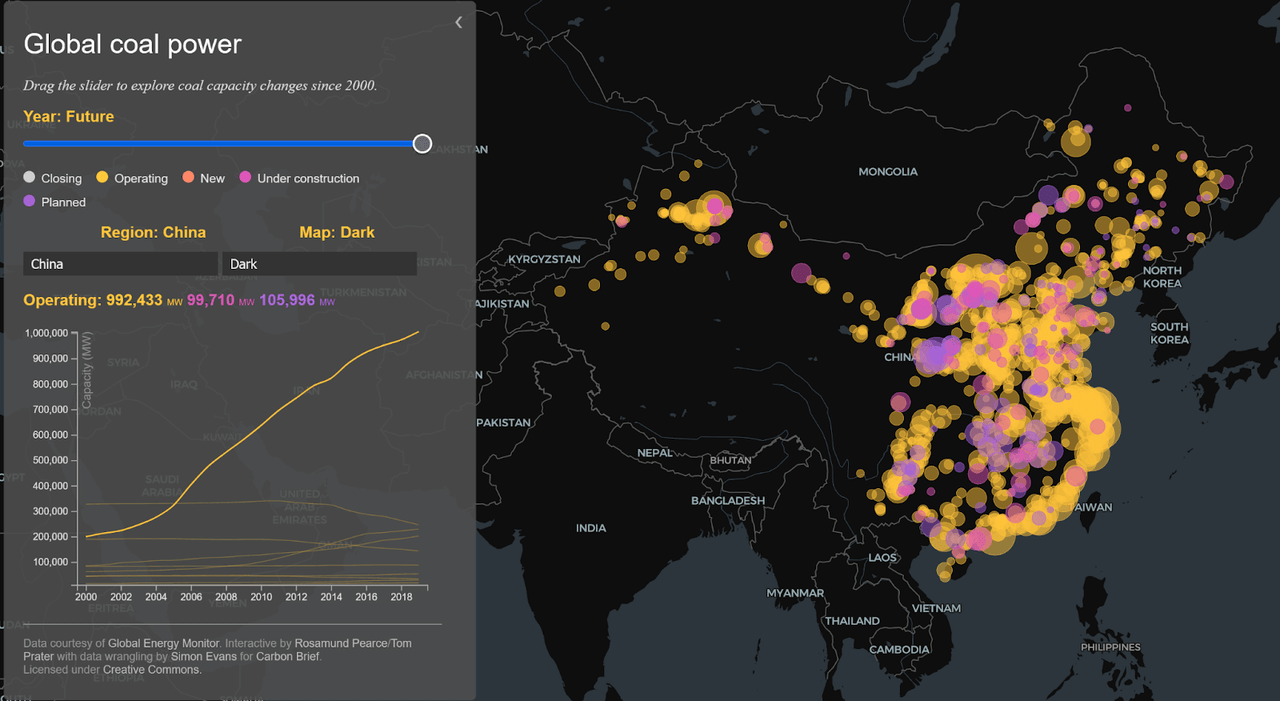

Although the US has zero planned (or currently under construction) coal fired power plants, the rest of the world is not playing so nicely. China has a “planned or under construction” increase of 20%, and India about 30%, Africa and the Middle East project an 80% increase. In fact, the United States is the only major region in the entire world without any planned increases proposed to date, even the EU can’t resist the black gold.

carbonbrief.org

Cheap and simple coal fired power plants are hard for developing nations to turn down. Why don’t they simply go with wind and solar, isn’t the LCOE cheaper anyway? Yes, in the long run, they should be cheaper - but the costs of renewables are highly front-loaded. For example, a solar panel is expensive to construct, but once installed, it generates energy with very low maintenance. A coal fired power plant has its costs more distributed over its lifetime. Therefore, if you want energy up and running soon and you’re on a budget, coal sounds appealing.

Not to mention, renewables require more sophisticated manufacturing and skilled labor - which is less available in developing regions.

The Western World grew on the back of cheap energy – now the rest of the world wants their turn.

Challenges with replacement

Most people feel like the government needs to pass a law to stop climate change, what’s so hard about that!?

But very few understand that almost all parts of society run on energy - which must be produced somehow. And, what a dramatic and unprecedented engineering undertaking it would take to build sufficient quantities of renewable infrastructure.

Cost of renewable infrastructure

Various studies (1,2,3,4,5) place the cost of transitioning the US energy grid over to renewable sources at between 5-10 trillion, some as high as 30 trillion. Their methodology generally seems to take the current leftover energy consumption after renewables, divided by the current cost of generating each unit of capacity needed, a pretty simple equation.

Let’s take a speculative look at what the additional expenses would really come out to be:

If we are to truly transition we also need to replace the transportation system, which is almost completely reliant on combustion engines (not just cars and busses, but also boats and airplanes). This would add another astronomical expense. Then, on top of that expense, we’ll need another massive build-out of renewable energy to supply all of these electric vehicles with electricity. It is hard to predict, but at least several trillions of dollars would be required to finance this expense.

The current transmission grid is aging and is not designed for this. It is not capable of handling this level of workload demand - and as such, that would need to be nearly entirely upgraded. Not to mention, a massive national network of battery storage would be required; which would require new and improved battery technology. Let’s throw an extra couple trillion on for that.

On top of all this, we would need to see an astounding increase in mining operations to produce astronomical amounts of rare earth metals such as copper, nickel, cobalt, silver, etc. in order to make all these batteries, electric motors and transmission systems. There goes a few more trillion.

We should also consider that the population is going to be growing, and that emerging markets like India and China have exhibited a dramatically increasing appetite for energy. Their populations want to consume meat and enjoy the amenities of the modern world.

Where do these additional costs leave us?

I’m hesitant to publish any specific numbers since the variables can be hard to predict and measure - and there’s a gap in comprehensive research. But if we look at these expenses through a lens that is a little more pessimistic and factor in a little waste and corruption in order to make some upside estimates, it is not hard to get somewhere around 40 to 60 trillion. Over a short time period like 10 years (yes, that’s short) it would equal about $1,600 to $2,133 per month for each adult. Of course, plenty of people are in prison, homeless, retired or simply won't pay anything. So at least a couple grand per month from each taxpayer will be needed - over the next 10 years. This would likely be paid through inflation, taxes and utility bills.

Naturally, we’d want to concentrate these expenses on the ultra wealthy and corporations; who can absorb more than your average Joe in profit margins and liquidation of assets. But those costs would soon be passed down to workers, customers and retirement accounts in price increases, wages and devaluations. The middle class would inevitably end up footing most of the bill. How would this play out in the future?

“Do you deeply care about climate change but feel you simply don’t have the money? Perhaps rent is going up and healthcare is already expensive? Well, don’t you worry, it turns out there’s a massive amount of job openings in the state run copper mines and the worker housing is quite affordable.”

The above offer might not play well in a stump speech…

It's very difficult for politicians to level with their constituents about this financial burden, reallocation of resources, and reduction in the standard of living that would be required. It’s far more politically lucrative to indefinitely collect votes based on a concern than it is to afflict their voters with the costs/discontent needed to rectify the concern.

This would in-fact be a worthwhile investment in the future of humanity, but voters react sharply to pain. The well-being of future generations becomes a distant concern when you need to choose between paying the rent or buying food.

Lack of rare earth metals

This report from EIA shows there is also a glaring gap in the mass quantity of resources needed. Right now the very large majority of rare earth minerals are coming from China. Which we are currently spiraling into a more and more combative and contentious trade and geopolitical stance with.

The report shows that some metals, like nickel, would need to increase production in quantities up to 30 times what they are today. We would need to open many massive copper mines. Simply, the permitting process of a new mine can easily take 3 to 5 years before a shovel is even put in the ground, let alone large quantities of production become deliverable.

Much of the opposition to these vast industrial undertakings comes from the very environmentalists who are most concerned about the climate. “Well see you can’t put a mine there because the green-nosed lizard might be disaffected,” “well, you certainly can’t put it over there either… a stream 10 miles away could be polluted,” and “you definitely can’t put it here, I’m not going to wake up and look at smoke stacks in the morning, think of my home equity!”.

As we can see, the difficulties with simply turning off this energy source like a faucet are immense.

Company and market technicals

The above confluence of macro, geopolitical and economic factors have conspired to put companies like ARLP in a prime position to capitalize on this demand.

A statement by the CEO from the last earning release:

"Global energy markets have continued to strengthen since our last earnings release in May," said Mr. Craft. "The economic forces driving the sharp rise in worldwide commodity prices remain generally intact ─ resilient energy demand, systemic supply shortages and fall out related to Russia’s invasion of Ukraine ─ and continue to support energy markets. Against this backdrop and as global power generators scramble to bolster low stockpiles in the near term and secure longer term reliable supply, ARLP was able to execute new coal sales commitments for delivery of 24.9 million tons through 2025 at prices above our recent expectations. As mentioned earlier, our coal operations have delivered significant year-over-year per ton margin expansion, and we believe ARLP is positioned to see further margin growth in 2023 and 2024.”

The company is seeing strong demand and has also stated they are seeing tight export markets.

Let’s take a look at the company.

It’s a pretty straight forward operation that mines coal and sells it to utility providers. Most of their product is thermal coal, which is used for energy generation - instead of metallurgical

coal, which is commonly used more to create steel. They also have royalty income for mineral and gas resources.

Interestingly, they’ve also taken a private equity position of 25 million in 2 companies, which out of all things, focus on electric energy. Francis Energy & Infinitum Electric who focus on EV charging stations and electric motors. Which actually might make sense, coal is used to produce electricity; where are all these EVs going to get electricity from? Hmmm.

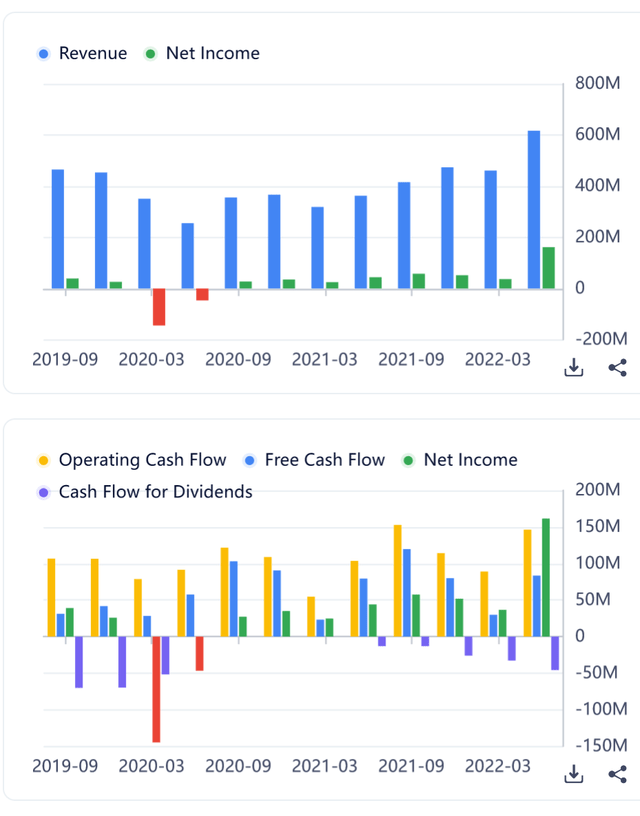

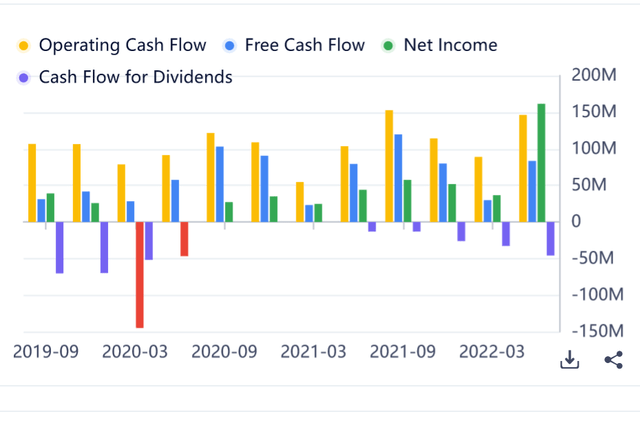

ARLP has a long history of great fundamentals, clear and consistent net margins, along with free cash flow. No complex financial engineering, debt funded stock buybacks or leveraged speculative bets. They took a little hit in 2020 and 2021 but have nicely recovered at this point.

On year-over-year basis, from Q2, their earnings have grown 370%. On a forward basis if they averaged no increase in earnings whatsoever for the next 3 quarters, the TTM PE it would be 4.54 which would be a contraction from the current 9.8 PE.

Gurufocus

Will we see multiple contraction? I don't think so, here's why. ARLP is the #1 highest ranking stock in the smoothed-momentum index. When stocks experience high momentum, they typically see multiple expansion, not contraction. It seems unlikely we'll see multiples contract - especially not when you have a growing dividend to support them.

Furthermore, other areas of growth in the market are quickly disappearing. The main indexes (QQQ,DIA,SPY) are dropping with 200 day SMA's all pointing downward. Bonds are crashing at the same time, growth stocks like the ARKK ETF are down 77% from their highs, even safe heavens like precious metals have broken through support and made 52 week lows recently, (gold -19% from highs, silver -38% from highs). BTC is also down -71%.

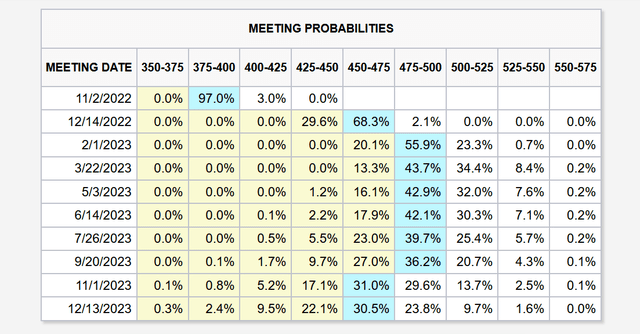

The Fed Funds Futures are showing plenty more rate hikes to come with a terminal rate of 5% around mid next year. So it's probably not time to start picking any bottoms yet.

cmegroup.com

Over the last 10 years many investors have been trained to look for the momentum and simply ride that. There are few areas still offering growth along with dividends and earnings to support it, I think we'll see more people being funneled into the remaining growth areas and multiples expanding; ARLP being one of them.

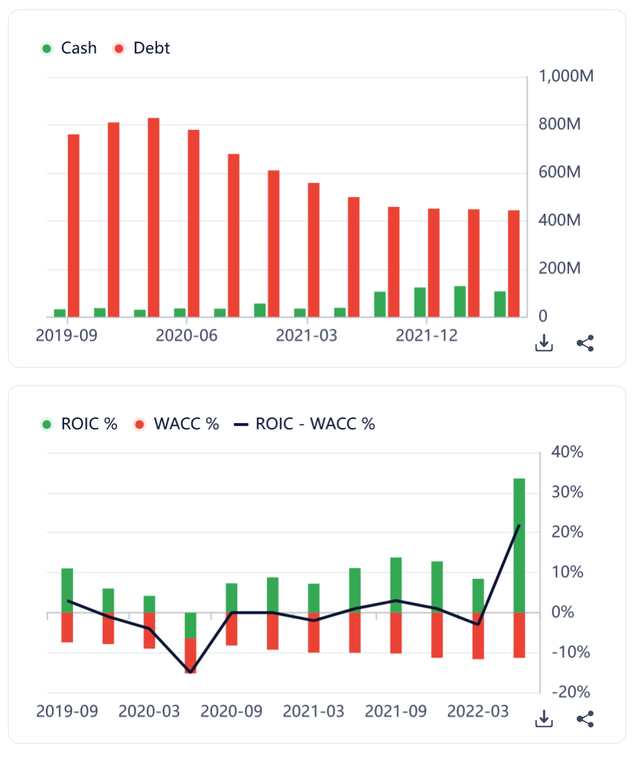

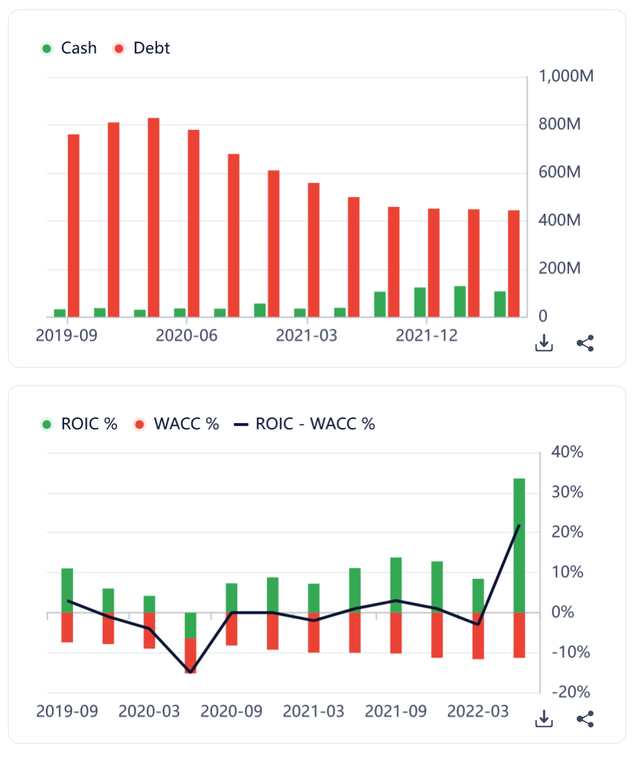

Balance Sheet

During the pandemic ARLP wisely took the opportunity to deleverage their balance sheet, many other companies simply refinanced at lower rates and actually increased their debt. But ARLP cut the dividend and bought back their bonds at a cheap price. Smart! They now have an Interest Coverage ratio of 10.28 and a Debt-EBITDA ratio of only 1.2 - which essentially means that it would take a little over a year of core profit to pay of their debt. This a very favorable position to be in.

GuruFocus

Many other companies will find themselves in a tight positions as they have to rollover large amounts of debt at higher interest rates. This will eat up profit margins, and in some cases margins will probably evaporate all together. But not ARLP. We can also see that ROIC (return on invested capital) has shot up to record levels.

Valuations Multiples

The company offers attractive multiples. Good luck finding another company appreciating 85% YOY with a PE of 9.87 and an EV-EBITDA of 8.31 along with a forward multiple of 2.9.

Balance Sheet

During the pandemic ARLP wisely took the opportunity to deleverage their balance sheet, many other companies simply refinanced at lower rates and actually increased their debt. But ARLP cut the dividend and bought back their bonds at a cheap price. Smart! They now have an Interest Coverage ratio of 10.28 and a Debt-EBITDA ratio of only 1.2 - which essentially means that it would take a little over a year of core profit to pay of their debt. This a very favorable position to be in.

GuruFocus

Many other companies will find themselves in a tight positions as they have to rollover large amounts of debt at higher interest rates. This will eat up profit margins, and in some cases margins will probably evaporate all together. But not ARLP. We can also see that ROIC (return on invested capital) has shot up to record levels.

Dividend

ARLP offers value to income investors looking for a healthy dividend. They are currently yielding 70.1% (Forward) and it has consistently grown from the lows of the pandemic, which was 10 cents/share to 40 cents/share. Management has consistently expressed that they understand the dividend is important to investors and is a key point of returning value. In the last earning call they talked about possibly adding additional amounts on top of the 30% payout ratio. As the dividend grows, so will the stock price. As the net profit grows, so will the dividend.

Gurufocus

We can also see that they are producing higher profit than before the pandemic - but the dividend is lower than before the pandemic. If there is a mean reversion in these ratios, it would equate to further increases in dividends.

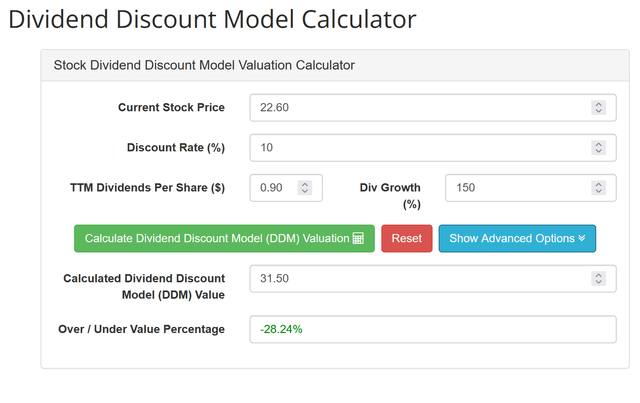

Let's take a look at a dividend discount model, I've factored in a growth rate which is less than analyst estimates (160%) and much, much lower than the current growth rate over the TTM (300%) - for the purposes of being conservative, I've used a growth rate of 150% over just the next 2 years. Which gives us a far value 31.50$. Meaning the stock is under valued by about 28.24%. I believe this is an easily attainable target based on macro factors I will outline below which will continue to drive demand.

If we were to use more traditional, long duration inputs, the model would produce astronomical numbers. But I don't believe that would be an appropriated projection due to the unique circumstances driving this much growth, along with long term head winds involving the energy transition, which I will also elaborate on in the below sections.

dqydj.com/dividend-discount-model-calculator/

Let’s take a look at the market and technicals

Neurlayses.com offers a dynamic composite sentiment score based on analyst ratings, price target changes and rating changes (buy, sell, hold, etc). Along with several other factors such as short interest, EPS estimates, options sentiment and aggregations of social sentiment. The company ranks 71 out of 100.

The coal industry currently has the highest 1-year average share price growth rate out of all 73 industries (table below). I’m sure Biden is quite excited to add that to his list of accomplishments. Coal also has the highest 1-year smoothed momentum score, which takes into account the consistency of the rate of change overtime - which increases the future predictive value of the indicator.

The EPS estimates really can’t be more enthusiastic, showing 200%+ YOY growth. And the recent revisions to the estimates have been up, up and away. In the chart below, the trailing light green lines coming from the earnings dates show the revision history for that release date and the dark green and yellow lines show the projected quarterly and yearly growth paths. The white vertical lines show the range of high and low estimates. There’s a lot of information packed into this little chart.

Using a dynamic composite score to measure several different components of EPS estimates which is then weighted by the analyst’s previous accuracy; the coal industry has the second highest score out of 73 industries. In the image below, it’s the column called “EPS Est.”

In looking at the social sentiment score the company is currently rated 9 out of 10. It's shown a little waver lately, but is still pretty high.

The only point of concern in the technicals is the short interest (chart below) it has consistently grown with the stock price. The short interest is currently 6.2% which is a little above average, but the steady rate of increase over time is interesting. It seems there are a few doubters out there that just can’t see this industry making it much further into the future. I hope they are prepared to wait.

We can see in the chart below that the broader Basic Materials sector has taken a large leg down as the hopes for a dovish pivot by the Fed have disintegrated. But the more specific coal industry has diverged and remained resistant to these fears. And ARLP in particular has outperformed its cohorts.

Global Recession Risk

The recent interest rate tightening cycle and QT from the Fed, which is being done to to reverse the consequences of their pandemic money printing bonanza, along with other central banks across the world. Is slowly drawing the consensus (with considerable delay) to the conclusion that it will in fact create a “real recession”. The yield curve inversion has a near perfect track record of predicting recessions, and an even better record of mainstream economists assuring us that “this time is different”.

It seems quite likely that a serious recession could hurt demand for energy and coal but considering the immense structural shortages creating demand and price pressure, this may have minimal impact on the bottom line. But these variables are hard to weigh against each other.

The Fed’s tightening cycle could also have an early end date, which may actually not come from weakness in the labor market, corporate bond spreads or Goldman Sachs having issues with derivatives. But instead, it could come from funding mechanisms for the Federal government seizing up, bond market liquidity is very poor, the debt is astronomical. Rolling over a bunch of short dated treasuries at interest rates which are many times higher, while the Fed is dumping supply on the market may not work out well. Interest rates could spike out of control or the bids simply won't be there. This will not be allowed to happen.

If the Fed needs to pivot and keep rates around 3% or lower while inflation is running hot at 5 to 6 percent. Inflation and commodity prices may rebound aggressively. So ARLP may be a good hedge if you are betting Jerome Powell can’t live up to his aspirations of being Pual Volcker when there’s $303 trillion of global debt and a 12 year asset bubble. The national debt is essentially unpayable, so we either: go through a bloody and humiliating default or take the easy path and keep printing.

Conclusion

I’m quite bullish on ARLP over, at least, the next 1 to 2 years. There are a lot of variables, like the Ukraine conflict reaching a resolution and the depth of demand destruction from the recession - these could change the outlook. But either way, I would probably not look at this as buy and hold over the next 10 to 20 years. The slow moving yet tectonic forces of the energy transition will inevitably bear down and won't leave survivors from humanity’s past. When the squeeze comes, just make sure you aren’t the last guy trying to get out of the room.